- #Calculating rate of return on future cashflows how to#

- #Calculating rate of return on future cashflows trial#

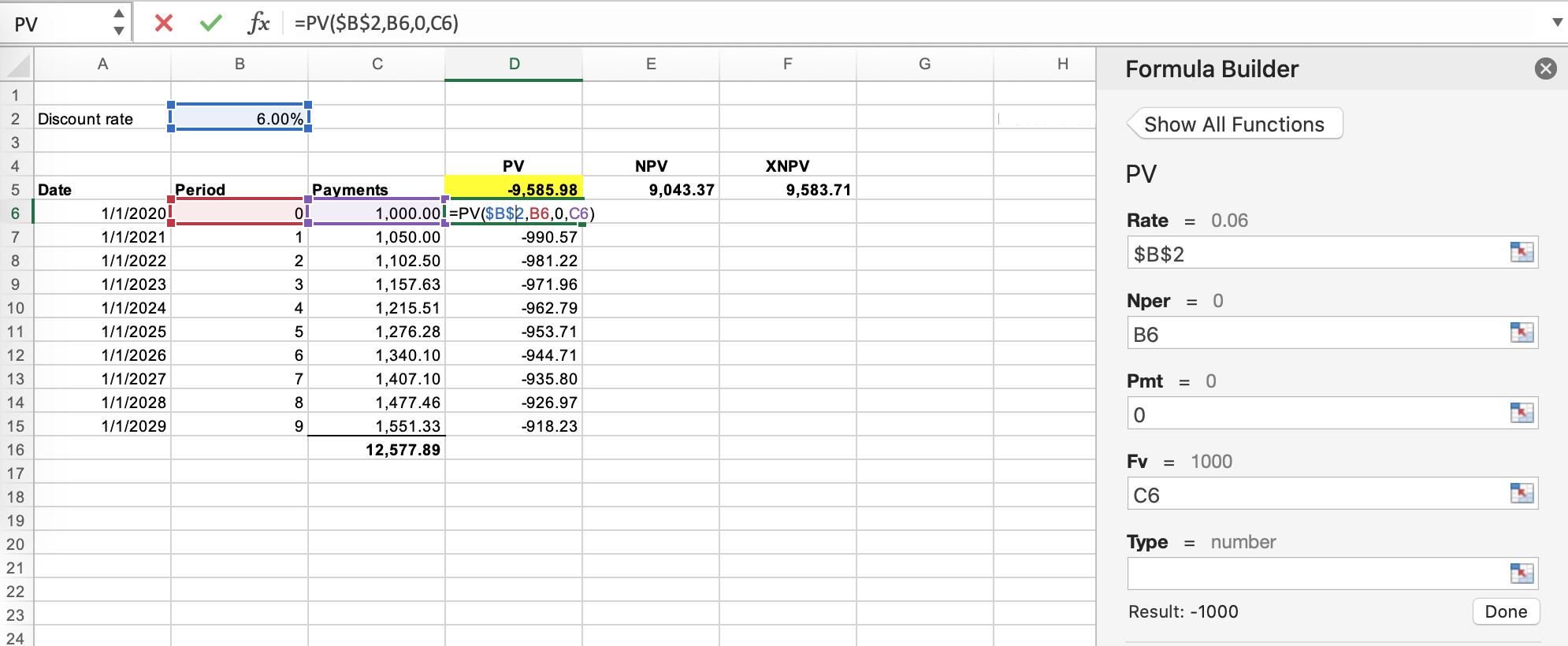

To judge the profitability of this investment, compare the XIRR output with your company's weighted average cost of capital or hurdle rate. Where A2:A8 are cash flows and B2:B8 are the dates corresponding to the cash flows: To find the internal rate of return for this investment, use this formula: Suppose you invested $1,000 in 2017 and expect to receive some profit in the next 6 years.

#Calculating rate of return on future cashflows how to#

How to calculate XIRR in Excel – formula examplesīelow are a few examples that demonstrate the common uses of the XIRR function in Excel. To simplify our calculation, we will be using the following array formula (please remember that any array formula must be completed by pressing Ctrl + Shift + Enter): To check the validity of this equation, let's test it against the result of the XIRR formula. If after 100 attempts an accurate rate is not found, the #NUM! error is returned. Starting with the guess if provided or with the default 10% if not, Excel goes through iterations to arrive at the result with 0.000001% accuracy.

#Calculating rate of return on future cashflows trial#

The XIRR function in Excel uses a trial and error approach to find the rate that satisfies this equation: XIRR in Excel always returns an annualized IRR even when calculating monthly or weekly cash flows.If dates are input in the text format, problems may occur. Dates must be valid Excel dates entered as references to cells containing dates or results of formulas such as the DATE function.All dates are truncated to integers, meaning that the fractional part of a date that represents time is removed.

The initial investment is not discounted subsequent payments are brought back to the date of the first cash flow and discounted based on a 365-day year.

6 things you should know about XIRR function For the result to display correctly, please make sure the Percentage format is set for the formula cell. How to calculate XIRR in Excel – formula examples.Thankfully, Microsoft Excel has another function to find IRR in such cases, and this tutorial will teach you how to use it.

In real life situations, however, cash inflows and outflows often happen at irregular intervals. That method is quick and straightforward, but it has an essential limitation – the IRR function assumes that all cash flows occur at equal time intervals such as monthly or annually. In our previous tutorial, we looked at how to calculate the internal rate of return with the Excel IRR function. When you are faced with a capital-intensive decision, calculating the internal rate of return is desirable because it lets you compare the projected returns for different investments and gives a quantitative basis for making the decision. The tutorial shows how to use XIRR in Excel to calculate the internal rate of return (IRR) for cash flows with irregular timing and how to make your own XIRR calculator.

0 kommentar(er)

0 kommentar(er)